Is Cybersecurity Insurance For Me? What To Know

- Admin

- Oct 11, 2021

- 2 min read

Published: October 06, 2021 on our newsletter Security Fraud News & Alerts Newsletter.

Cybersecurity insurance isn’t the foolproof antidote to cybercrime, but for the right person or business, it can make a lot of sense. Help with recovering from a cyberattack is something everyone can use, especially with the chaos and financial losses that can follow. Insurance for these incidents can be a practical consideration, like having home or auto protection.

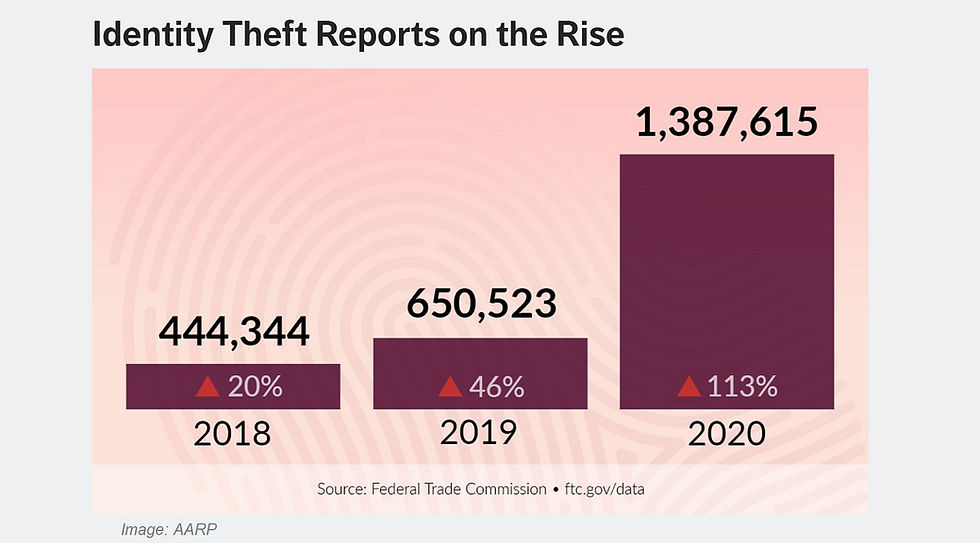

The pandemic provided a catalyst for cyberattacks to spike in ways that had yet to be seen. According to a report by the Identity Theft Resource Center, when compared to the last quarter of 2020, the number of cybercrime victims is up 564% so far this year.

Data from the United Nations finds attackers have also been unusually busy, with a 600% jump in their activity since March of last year. That begs the question of how to best protect ourselves online, and how we can also prepare for becoming the next victim of a cybercrime. Enter, cybersecurity insurance…

Coverage for personal and home protection assists with things like replacing a device compromised in a data breach or something more personal like being the victim of cyberthreats.

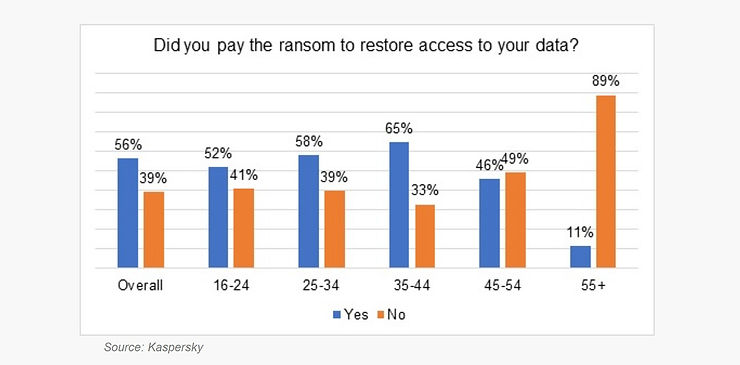

Coverage for cyber extortion such as being threatened by criminals demanding the release of sensitive information or funds, or cybercriminals using ransomware to encrypt your data, rendering your device to their control.

Coverage for financial loss and fraud from cyberattacks helps in many ways. It includes covering theft of finances from your bank and the loss of finances due to fraudulent use of your credit data.

Coverage for your business can protect it from a breach and the compromise of client information. It covers you for any legal actions by a client, including privacy violations, defamation, and fraud.

Promotes overall cyber well-being by promoting measures keeping you safe online. They include monitoring services for breaches, services by fraud specialists, and help with compromised data and retrieval of personal and financial documents.

Some homeowner policies include cyber insurance but can be limited, so check coverage details. There’s also stand-alone cyber insurance, including policies as a separate add-on to homeowner insurance. Another option for cyber insurance includes digital packages providing comprehensive technical protection like a VPN (virtual private network), antivirus solutions, and Wi-Fi security combined with identity theft and credit monitoring coverage.

As one security expert sees it “Breaches have become the third certainty in life behind death and taxes.” So, whether you do or don’t end up with cybersecurity insurance is of course up to you, but at the very least, now you know you have options and what they are.

Keep up to date: Sign up for our Fraud alerts and Updates newsletter

Want to schedule a conversation? Please email us at advisor@nadicent.com

Comments